Financial institutions invest millions of dollars every year to create digital customer experiences and grow electronic payments in their markets. However, in Latin American countries, our data suggests a general lack of focus on a key piece of the digital customer journey–credit authorization.

In certain Latin American countries, three out of 100 “Card Present” (face-to-face) transactions are declined, yet a surprising two out of 10 “Card Not Present” (e-commerce) transactions are declined1. This can result in customers no longer actively using that card.

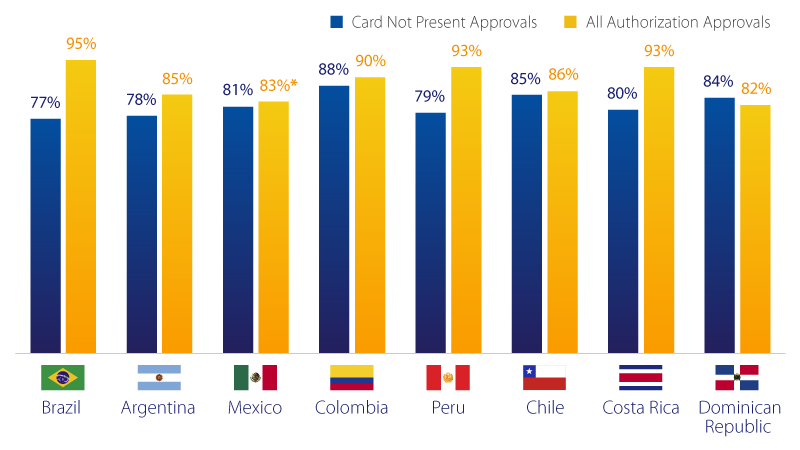

Transaction approval rates in Latin America (overall)1

*Denotes only cross-border spending authorizations for Mexico